27+ Early Ira Withdrawal Calculator

Web Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Web To ensure that seniors with tax-deferred accounts eventually pay taxes on their investments the IRS institutes Required Minimum Distributions at the age of 73.

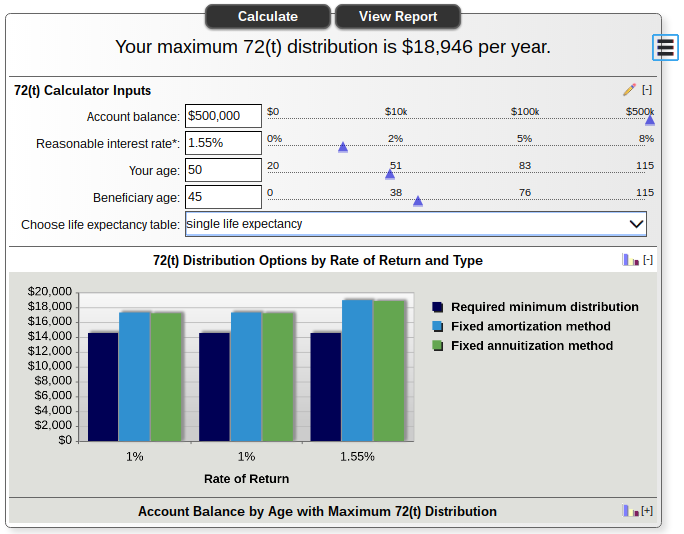

The 72 T Rule Making Penalty Free Ira Withdrawals Before Age 59 Seeking Alpha

Web The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life.

. Web High yield 10000 MMA. Use them to decide which types of IRA to fund. High yield 25000 MMA.

Web Determining how much you are required to withdraw is an important issue in retirement planning. Web The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost. A plan distribution before you turn 65 or the plans normal retirement age if earlier may result.

Web Our calculator enables you to see the impact of an early 401k withdrawal in terms of lost investment opportunities. Use this calculator to determine your Required Minimum Distributions. You need to pay income tax on an IRA early withdrawal.

Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Web You can withdraw 60025 at the beginning of each month to deplete your expected balance by the end of your retirement. Web 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator.

Web Required minimum distributions RMDs are the minimum amounts you must withdraw from your retirement accounts each year. Compare IRAs get Roth conversion details and estimate Required Minimum. Web TraditionalSIMPLESEP IRA Before Tax Traditional SIMPLE or SEP IRA After Tax Roth IRA After Tax Regular Taxable Savings After Tax Age.

Web There are several exceptions to the early withdrawal penalty if you use the money for specific purposes. Use these free retirement calculators to determine how. Taxes and penalties In many cases youll have to pay.

The exception applies to unreimbursed medical expenses. A distribution to cover medical costs may not be subject to penalty. Web How much tax you owe on an IRA withdrawal depends on your age the type of IRA and other factors.

Web When you take a withdrawal from a SIMPLE IRA before age 59½ the IRS considers your withdrawal an early distribution. High yield jumbo MMA. All you need to do is type in each of the.

High yield 50000 MMA. You generally must start taking withdrawals. If you have enough money in other accounts to cover your expenses you dont have to touch the money in your.

Web Do I have to make withdrawals from my IRA. Discover your retirement age and income in just 3 minutes. Web Withdrawals from a traditional IRA If all of your contributions to your traditional IRA were tax-deductible the calculation is simple -- all of your IRA withdrawal.

Web Open a Schwab IRA today. Not an easy task. Web See Retirement Topics - Hardship Distributions.

Web To calculate the penalty on an early withdrawal simply multiply the taxable distribution amount by 10. Use this calculator to estimate how much in taxes you could owe if. Web Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs.

For example an early distribution of 10000 would incur. Web Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional. Use our IRA calculators to get the IRA numbers you need.

Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. Ad Free retirement calculator built for Americans.

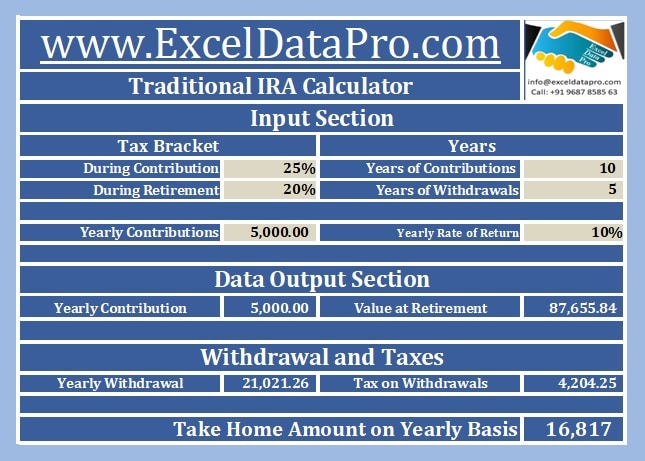

Download Traditional Ira Calculator Excel Template Exceldatapro

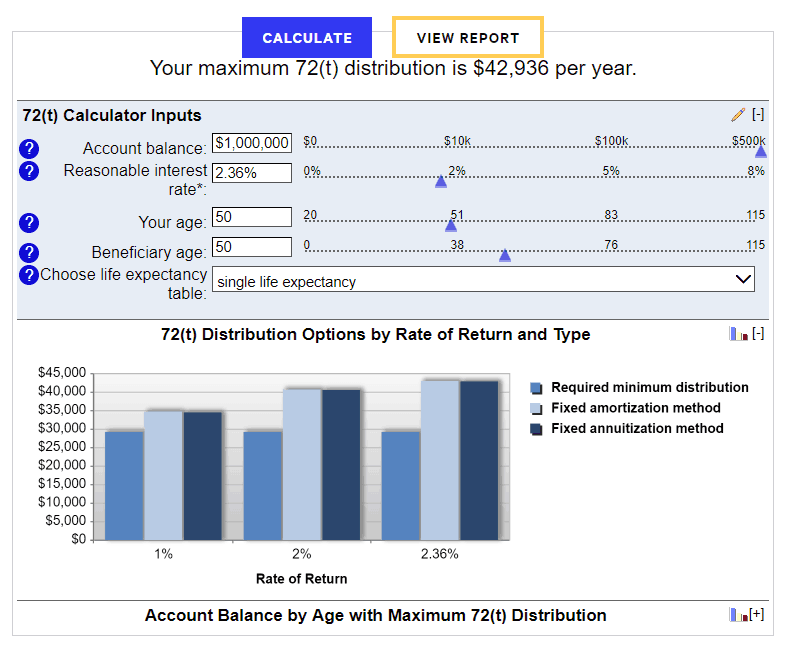

Ira Withdrawal Calculator Estimate Your Retirement Income 2023

401k Withdrawal Calculator Shows How Much Money You Ll Get

Roth Ira Calculators

72t Distribution How To Get Early Access To Your Retirement Savings

Required Ira 401 K Withdrawals Start At Age 75 Under Congress Bill

Ion Mobility Mass Spectrometry Reveals The Structures And Stabilities Of Biotherapeutic Antibody Aggregates Analytical Chemistry

401 K Early Withdrawal Calculator Nerdwallet

Fire Calculator When Can I Retire Early Engaging Data

6 Things To Know About Roth 401 K Withdrawals The Motley Fool

401 K Early Withdrawal Calculator Nerdwallet

401 K Early Withdrawal Calculator Nerdwallet

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

10 Roth Ira Investment Templates In Pdf

Annuity And Insurance Learning Lab The Annuity Expert

Retirement Withdrawal Calculator